Gross Margin Formula Write for Us – We welcome you to Market Watch Media, now open to guest posts and blog advertising. Thank you for showing interest in writing a Market Watch Media guest post. We are glad you are here.

Note:- Before submitting articles, please read our guest writing policies.

So, If you have any queries regarding guest posts, never hesitate to ask us here: contact@marketwatchmedia.com

Gross Margin Formula Write for Us

The Gross Margin Formula is a pivotal financial metric that reveals the profitability of a company’s core business operations. It clearly shows how efficiently a company generates profits from its products or services. Businesses can assess their financial health and operational efficiency by subtracting the direct production costs (Cost of Goods Sold, or COGS) from total revenue and expressing the result as a percentage. This formula is indispensable for evaluating pricing strategies, cost management, and overall profitability, making it a cornerstone in financial analysis and decision-making for organizations of all sizes and industries.

What is the Gross Margin Formula?

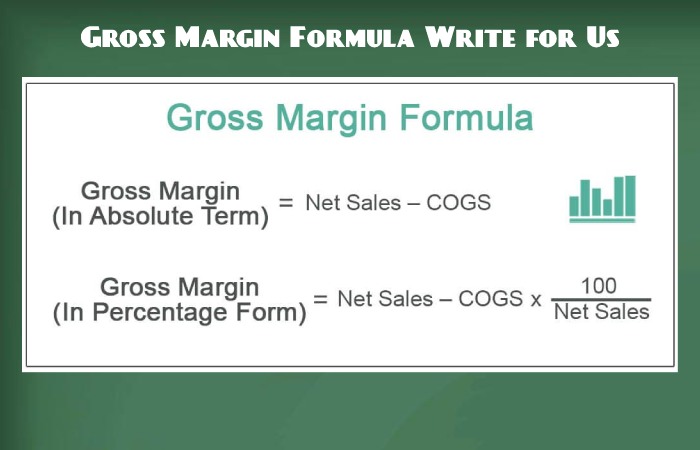

The Gross Margin Formula calculates the profitability of a company’s core operations. It is calculated by subtracting the Price of Goods Sold (COGS) from total revenue and expressing the result as a percentage of revenue. The formula is Gross Margin (%) = [(Revenue – COGS) / Revenue] x 100%.

The formula to calculate gross margin is:

GrossMargin(%)= Revenue(Revenue−CostofGoodsSold) ×100%

Here’s a Breakdown of the Components:

- Revenue: This represents the total income generated from sales of goods or services. It is the starting point for calculating gross margin.

- Cost of Goods Sold (COGS): COGS includes all the direct costs of making or purchasing the goods or services sold. These costs typically include raw materials, labor, manufacturing, and other expenses directly tied to production. For a service-based business, this might include labor costs directly related to delivering the service.

- Gross Margin (%): The result of the formula is expressed as a fraction, representing the proportion of revenue that remains after covering the direct production costs.

Importance of Gross Margin:

- Profitability Assessment: Gross margin reveals the profitability of a company’s core operations. A higher gross margin designates that the company generates more profit than its production costs.

- Cost Efficiency: It helps assess the efficiency of production processes and cost control measures. A declining gross margin might signal inefficiencies or increased production costs.

- Pricing Strategy: Companies can use gross margin data to evaluate their pricing strategies. For instance, a company might consider raising prices or cutting production costs if the gross margin is too low.

- Comparative Analysis: Gross margin can be used to compare the performance of different product lines, business segments, or competitors within the same industry.

- Investor and Lender Confidence: Investors and lenders often look at gross margin when evaluating a company’s financial health and sustainability. A healthy gross margin suggests the Business can cover its costs and generate profit.

- Strategic Decision-Making: Companies can use gross margin insights to make strategic decisions, such as reserve allocation, product development, and expansion plans.

How to Submit Your Articles?

We hope you read our guidelines carefully before writing content for our website. Once you have read the guidelines for our guest postings if you want to write for us, email us directly at contact@marketwatchmedia.com

The Benefits of Contributing to Market Watch Media

- Build your credibility online.

- Promote your brand.

- Increase traffic to your site.

- The Business becomes more productive.

We accept guest posts on the Topics

- TECHNOLOGY

- TRADING

- FOREX

- Business

- MARKETING

- CRYPTOCURRENCIES

- BUSINESS NEWS

- MARKET UPDATES

Why Write for Market Watch Media – Gross Margin Formula Write for Us

- Writing for Market Watch Media can expose your website to customers looking for Gross Margin Formula.

- Market Watch’s Media presence is on Social media, and we will share your article with the Gross Margin Formula-related audience.

- You can reach out to Gross Margin Formula enthusiasts.

Search Terms Related to the Gross Margin Formula Write for Us

Gross margin calculation

Gross margin percentage formula

How to calculate gross margin

Gross profit margin equation

Gross margin vs. net margin

Analysis Gross margin

Gross margin ratio

Improving gross margin

Gross margin benchmark

Gross margin industry standards

Financial Analysis in Gross Margin

Gross margin for small businesses

Gross margin for retail businesses

Manufacturing for Gross margin

Gross margin in e-commerce

Gross margin and pricing strategy

Cost Control and Gross margin

Gross margin and profitability

Gross margin and business performance

Trends Gross margin

Search Terms for Gross Margin Formula Write for Us

Gross Margin Formula Write for Us

Gross Margin Formula Guest Post

Contribute Gross Margin Formula

Gross Margin Formula Submit Post

Gross Margin Formula submitted an article.

Become a guest blogger for Gross Margin Formula.

Gross Margin Formula writers wanted

The Gross Margin Formula suggests a post.

Guest Author Gross Margin Formula

Article Guidelines on Market Watch Media – Gross Margin Formula Write for Us

- Market Watch Media welcomes fresh and unique content related to the Gross Margin Formula.

- Market Watch Media allows at least 500+ words associated with Gross Margin Formula.

- The editorial team of Market Watch Media does not encourage promotional content related to the Gross Margin Formula.

- To publish the article at Market Watch Media, email us at contact@marketwatchmedia.com

- Market Watch Media allows articles related to Technology, Trading, Forex, Business, Marketing, Cryptocurrencies, Business News, Market Updates, and many more.

Related Page

Accounting Write for Us

Adverse Selection Write for Us

Affiliated Marketing Write for Us

Asset Management Write for Us

ATM Write for Us

Backorder Write for Us

Balanced Scorecard Write for Us

Bear Market Write for Us

Benchmarks Write for Us

Capital Expenditures Write for Us

Dividend Yield Write for Us