Section 179 Deduction Write for Us

We welcome you to Market Watch Media, now open to guest posts and blog advertising. Thank you for showing interest in writing a Market Watch Media guest post. We are glad you are here.

Note:- Before submitting articles, please read our guest writing policies.

So, If you have any queries regarding guest posts, never hesitate to ask us here: contact@marketwatchmedia.com

Section 179 Deduction Write for Us

the Section 179 Deduction. This powerful provision in the U.S. tax code allows businesses to accelerate depreciation deductions on qualifying assets, potentially saving substantial tax sums. Exploring the Section 179 Deduction, we uncover its nuances, benefits, and practical applications. From understanding eligible assets to maximizing deductions, we delve deep into this tax-saving tool. Join us as we navigate the intricacies of Section 179, empowering you to make informed financial decisions and optimize your tax liability.

What is Section 179?

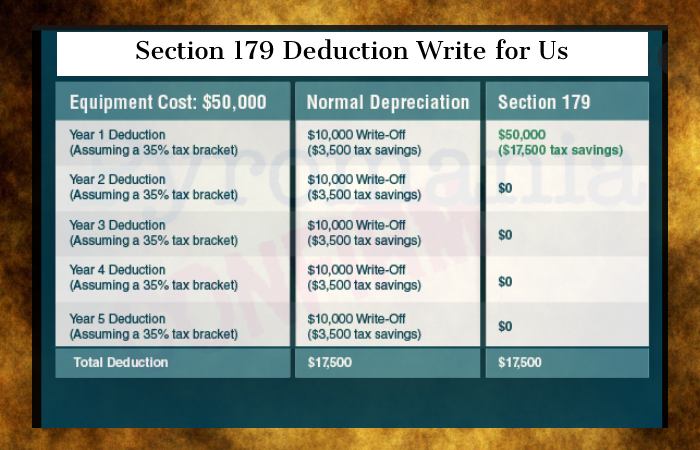

Section 179 is a provision in the U.S. tax code that allows businesses to deduct the cost of qualifying equipment and property purchases as an expense rather than depreciating them over time. It offers a tax incentive for businesses to invest in and stimulate economic growth by deducting these expenses in the year of purchase.

How Section 179 works

Section 179 provides businesses with a tax-saving method for deducting the cost of qualifying assets in the year they are placed in service. Here’s how it works:

- Asset Purchase: When a business buys eligible equipment, vehicles, or property, it can elect to deduct the full cost up to a specified limit rather than depreciating it over several years.

- Annual Limit: The IRS sets an annual limit on the deduction, which can vary. In recent years, it has been around $1 million.

- Asset Qualification: To qualify, assets must be used primarily for business purposes, such as machinery, vehicles, computers, and office furniture.

- Tax Savings: By claiming the Section 179 deduction, businesses can reduce their taxable income for the year, potentially lowering their overall tax liability.

- Phase-Out: The deduction begins to phase out if the total asset purchases for the year exceed a certain threshold, another limit set by the IRS.

- Flexibility: This provision allows businesses to invest in necessary assets while enjoying significant upfront tax savings, helping with cash flow and growth.

- Consultation: It’s advisable to consult with a tax professional or accountant to ensure compliance with IRS rules and optimize the deduction’s benefits.

In summary, Section 179 incentivizes business investment by permitting the immediate deduction of qualifying asset costs, providing potential tax savings that can be crucial for financial planning and growth.

What Expenses Qualify for Section 179?

Section 179 of the U.S. tax code allows businesses to subtract the cost of qualifying equipment and property purchases, including machinery, vehicles, computers, and furniture, up to a specified limit. These purchases must be used for business purposes and not exceed the annual limit set by the IRS.

What are the Section 179 Limits for 2023?

The Section 179 deduction limit for 2023 is $1,160,000. It means businesses can deduct the total purchase price of qualifying equipment up to $1,160,000 annually.

How to Submit Your Articles?

We hope you read our guidelines carefully before writing content for our website. Once you have read the guidelines for our guest postings, if you want to write for us, email us directly at contact@marketwatchmedia.com

The Benefits of Contributing to Market Watch Media

- Build your credibility online.

- Promote your brand.

- Increase traffic to your site.

- The Business becomes more productive.

We accept guest posts on the Topics

- TECHNOLOGY

- TRADING

- FOREX

- Business

- MARKETING

- CRYPTOCURRENCIES

- BUSINESS NEWS

- MARKET UPDATES

Why Write for Market Watch Media – Section 179 Deduction Write for Us

- Writing for Market Watch Media can expose your website to customers looking for a Section 179 Deduction.

- Market Watch’s Media presence is on Social media, and we will share your article with the Section 179 Deduction-related audience.

- You can reach out to Section 179 Deduction enthusiasts.

Search Terms Related to the Section 179 Deduction Write for Us

Section 179 deduction limits

Section 179 tax code

Qualifying assets for Section 179

Section 179 expense deduction

Section 179 vehicle deduction

IRS Section 179 rules

Section 179 depreciation

Calculator Section 179 deduction

Section 179 vs. bonus depreciation

2023 for Section 179 limits

Section 179 software deduction

Small Businesses for Section 179 deduction

Section 179 real estate deduction

Section 179 deduction extension

Farm Equipment for Section 179 deduction

Section 179 SUV deduction

Section 179 deduction changes

Leasehold Improvements for Section 179 deduction

Section 179 deduction for non-profits

Section 179 deduction for startups

Search Terms for Section 179 Deduction Write for Us

Section 179 Deduction Write for Us

Section 179 Deduction Guest Post

Contribute Section 179 Deduction

Section 179 Deduction Submit Post

The Section 179 Deduction submitted an article.

Become a guest blogger for Section 179 Deduction.

Section 179 Deduction writers wanted

Section 179 Deduction suggests a post.

Guest Author Section 179 Deduction

Article Guidelines on Market Watch Media – Section 179 Deduction Write for Us

- Market Watch Media welcomes fresh and unique content related to the Section 179 Deduction.

- Market Watch Media allows at least 500+ words associated with the Section 179 Deduction.

- Market Watch Media’s editorial team does not encourage Section 179 Deduction promotional content.

- To publish the article at Market Watch Media, email us at contact@marketwatchmedia.com

- Market Watch Media allows articles related to Technology, Trading, Forex, Business, Marketing, Cryptocurrencies, Business News, Market Updates, and many more.